In these pandemic times, we take into account more than ever everything digital: paying by card, with the mobile phone, consuming entertainment with paid subscriptions or managing our company using software hosted in the cloud. However, we continue to have several types of cheques in circulation with which many companies continue to operate.

Whether you have never received a payment by check or if your company uses them every day, it is convenient that you know all the types of cheques that we are going to discuss in the following article:

Table of Contents

1. What is a cheque?

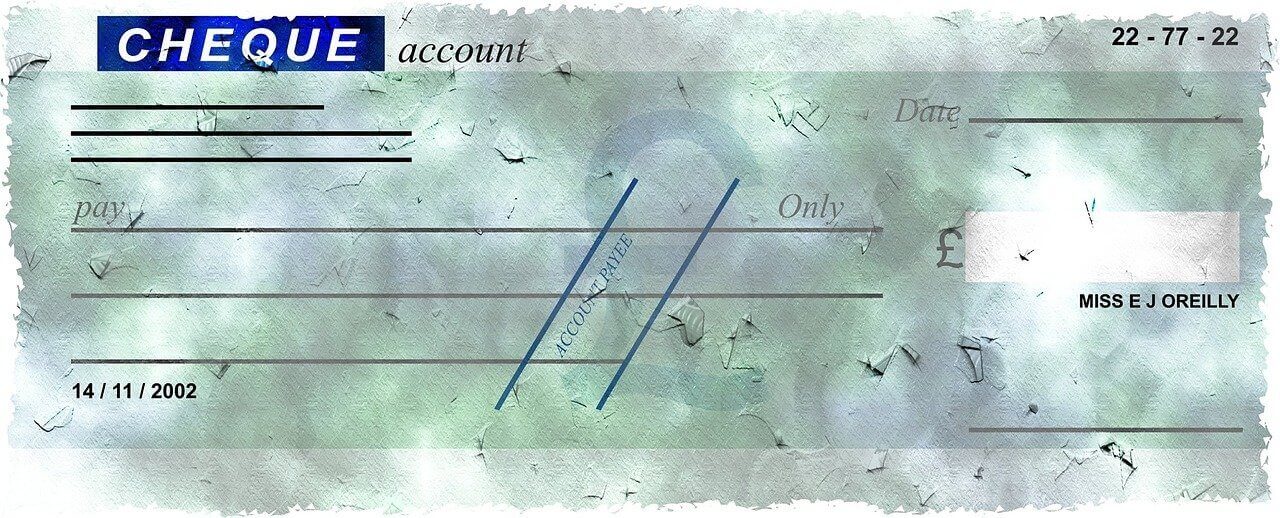

Cheques are issued by banks, which will be responsible for their payment, and whose details are included in the cheque. Therefore, the other information on a cheque are the names of the issuer and beneficiary, the amount of money, the date and place of issue, the issuer’s bank account number, and the issuer’s signature.

2. Types of cheques

Although the best known are bearer and nominative cheques, there are several more types, which we explain below:

Certified cheque

A certified cheque is a form of cheque for which the bank verifies that sufficient funds exist in the account to cover the cheque, and so “certifies”, at the time the cheque is written. Those funds are then set aside in the bank’s internal account until the cheque is cashed or returned by the payee.

Crossed cheque

We can easily identify a crossed cheque if it has two parallel lines on it. The crossed cheque is a nominative check and can only be cashed to an account (it cannot be cashed in cash).

Nominative cheque

As you can deduce from its name, the details of the beneficiary (person or company) appear on it. The main advantage of the nominative cheque is that it is much safer than the well-known bearer cheque since it can only be cashed by the beneficiary.

However, the beneficiary may need another person to cash the cheque. This requires an endorsement. But there are cases in which the endorsement is not possible, as in account payee cheques. In those in which it can be done, the beneficiary will have to write the details of the new beneficiary.

Bearer cheque

The bearer cheque is the best known and probably the most common. Unlike the nominative, the bearer cheque does not contain any information about the beneficiary, so it can be cashed by anyone who has it in their possession. Obviously, this entails security problems in terms of cashing for the beneficiary, since if they lose it, another person can cash it.

Traveller’s cheque

In contrast to the two previous cheques, which are the most common, the traveller’s cheque is the least used by far. They are issued by banking entities (or non-banking financial organizations such as Visa, Mastercard or American Express) and ensure that the beneficiary will be able to pay or cash in any other currency if the establishment accepts it. In addition, they do not have an expiration date.

Other types of cheques

Last but not least, there are other types of cheques that we must also consider:

- Banker’s cheque: The bank itself is the issuer, that is, it signs and pays the cheque.

- Cheque for deposit only: It is compulsory that it has the expression “for deposit only” written on it. Its peculiarity is that it cannot be cashed in cash, only through bank account deposit.

- Cheque on the Bank of Spain account: The Bank of Spain itself is in charge of paying the amount.

- Delivery receipt: This is not necessarily a type of cheque, but rather, it is what the bearer signs when they receive the money from their cheque.

FAQ about cheques

How to cash a check?

Go to the banking entity that appears on the cheque. Otherwise, you will not be able to cash it.

Can I cash a cheque at an ATM?

Not all banking entities allow it. Find out at the bank in advance.

What does it take to cash a cheque?

To cash a bearer cheque, you will not need to identify yourself, but in the rest of the cheques you will. However, if the bank has not endorsed the cheque, no one guarantees the payment of funds.

Can I cash a cheque at any bank?

Banks are not required to pay a cheque from another entity. Those who accept the service charge an extra commission for doing so.

How long do I have to cash a cheque?

You have 15 days in Spain, 20 days if it has been issued in Europe, and 60 days if it has been issued in another part of the world.

How long does it take to cash a cheque?

Between 2 and 3 business days. It can be delayed depending on the amount to be cashed or the relationship of the beneficiary with the bank.

How do I cash a cheque that is not in my name?

You will need to appear as endorsed of the cheque. Otherwise, you will not be able to cash it.

Try STEL Order to easily manage payments and collections for your company. It is the easiest-to-use cloud ERP software.